Weekly paycheck calculator indiana

We use the most recent and accurate information. Ad Create professional looking paystubs.

Artistic Director Salary And Cost Of Living Data For Indianapolis Indiana Cost Of Living Salary Data

Switch to Indiana salary calculator.

. Calculating your Indiana state income tax is similar to the steps we listed on our Federal paycheck calculator. Once youve calculated each employees net pay youll be ready to spread the wealth. The state income tax rate in Indiana is a flat rate of 323.

Ad Compare This Years Top 5 Free Payroll Software. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

Supports hourly salary income and multiple pay frequencies. How do I calculate taxes from paycheck. In case you earn hourly wages and wish to calculate how that translates to annual wages its key to know how many hours youre working each week.

How do I calculate annual wages from hourly pay. Indiana Income Tax Brackets and Other Information. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

Our online Weekly tax calculator will automatically work out all your deductions based on your Weekly pay. This means that you get a full Federal tax calculation and clear understanding of how the figures are calculated. Computes federal and state tax withholding for paychecks.

Free Unbiased Reviews Top Picks. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404.

It determines the amount of gross wages before taxes and deductions that. Youre almost at the finish line. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

The results are broken up into three sections. New employers pay a flat rate of 255. Start a new calculation.

Automatic deductions and filings direct deposits W-2s and 1099s. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Your results have expired.

Supports hourly salary income and multiple pay frequencies. The amount by which your disposable earnings exceed 30 times 725 is 28250 500 30 725 28250. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

Salary Paycheck Calculator Indiana Paycheck Calculator Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Indiana.

A state standard deduction exists in the form of a personal exemption and varies based on your filing status. 401k 125 plan county or other special deductions. The tax calculator provides a full step by step breakdown and analysis of each tax Medicare and social security calculation.

These results are generated by multiplying your base hourly salary by the number of hours weeks or months you work yearly assuming that youre working 40 hours per week. Flexible hourly monthly or annual pay rates bonus or other earning items. Below are your Indiana salary paycheck results.

Next divide this number from the annual salary. In a few easy steps you can create your own paystubs and have them sent to your email. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

If you make 500 per week after all taxes and allowable deductions 25 of your disposable earnings is 125 500 25 125. Minimum Wage in Indiana. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Switch to Indiana hourly calculator. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

For sales tax please visit. Why Gusto Payroll and more Payroll. As an employer in Indiana you will have to pay the state unemployment insurance SUI which ranges from 05 to 74 on a wage base of 9500 per employee.

Our paycheck calculator converts your hourly pay to periodical earnings like per week month and year. This Indiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. The maximum amount that can be garnished from your weekly paycheck is 125 since the lesser amount.

If you use our salary and paycheck calculator youll be able to make your own weekly monthly or annual calculations. Change state Check Date General Gross Pay Gross Pay Method. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. State Date State Indiana. Indiana Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck calculator. Use this Indiana gross pay calculator to gross up wages based on net pay. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Illinois Salary Paycheck Calculator Gusto Chicago Bars Chicago Pizza Chicago City

Pay Off Credit Cards Consolidate Debt And Build Credit Faster Personal Loan Rates As Low As 3 49 Ap Personal Loans Paying Off Credit Cards Money Sweepstakes

Find Your Best Personal Loan

Indiana Hoosiers Indiana Hoosiers Svg Indiana Hoosiers Logo Indiana Hoosiers Clipart Indiana Hoosiers Indiana Hoosiers

Indiana Paycheck Calculator Smartasset

Vintage Ceramic Ashtray Associated Investment Company South Bend Indiana In 2022 Vintage Ceramic Investment Companies Gold Rims

1 Change The C Code To Calculate The Perimeter Of A Triangle Support Your Experimentation With A Screen Capture Of Executing The New Code Exam Answer Ashford Online University

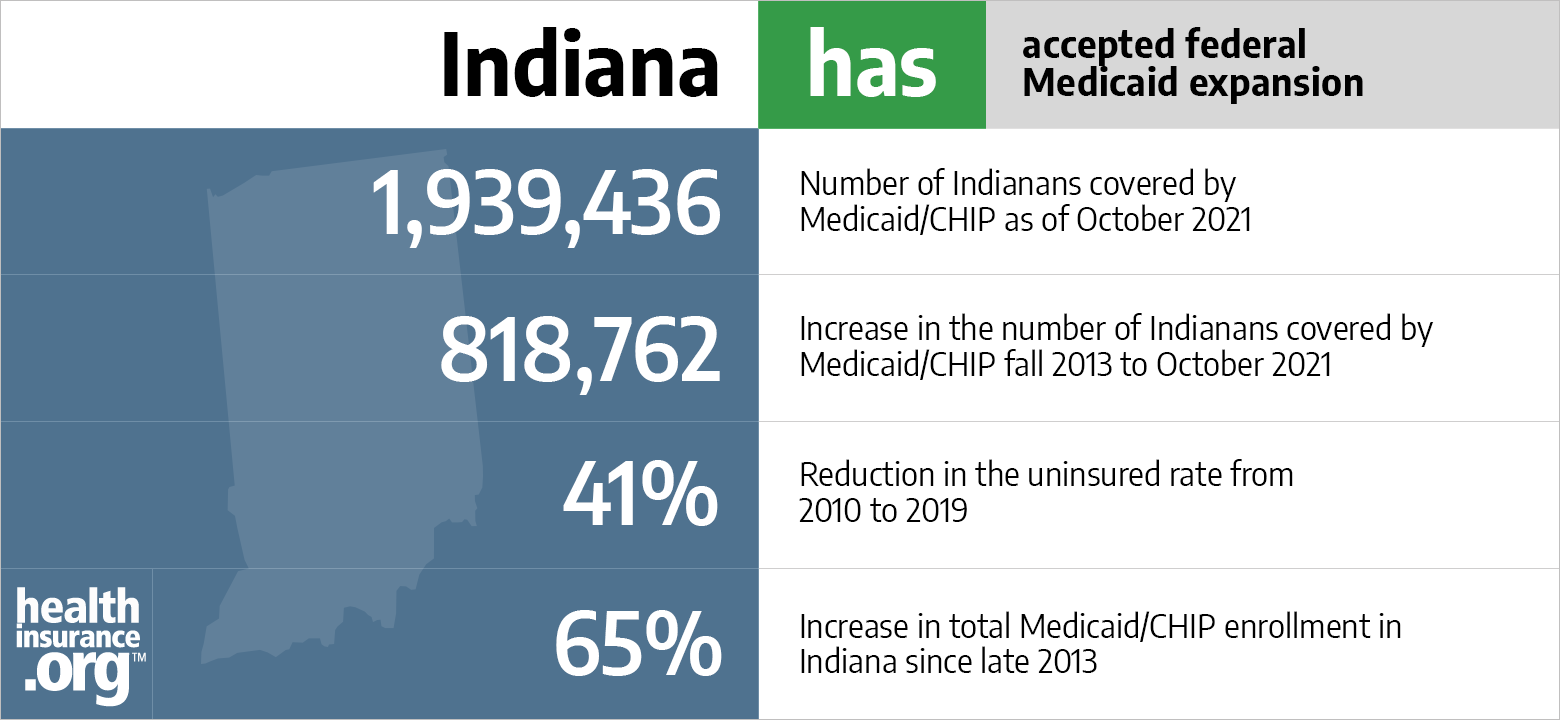

Aca Medicaid Expansion In Indiana Updated 2022 Guide Healthinsurance Org

Paying Off Debt Worksheets Paying Off Credit Cards Credit Card Payoff Plan Debt Snowball Worksheet

Indiana Paycheck Calculator Adp

![]()

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Employee Total Compensation Calculator Calculators By Calcxml Compensation Calculator Calculators

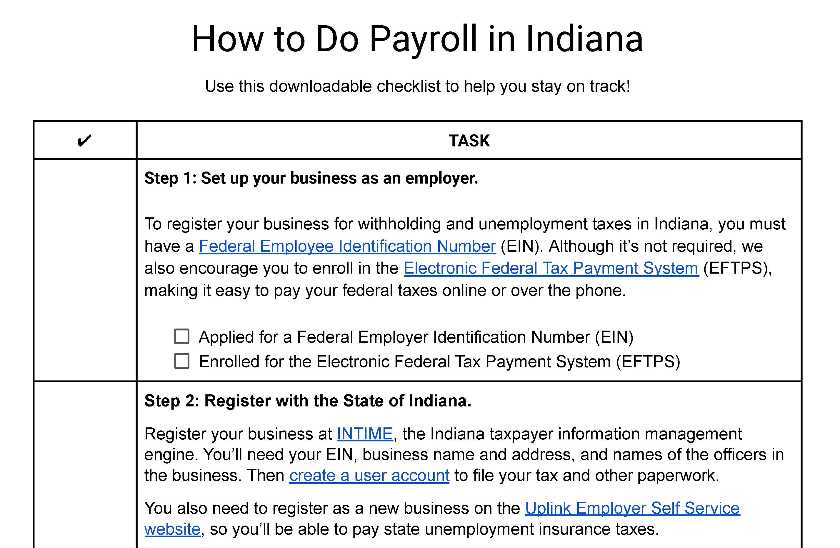

How To Do Payroll In Indiana What Every Employer Needs To Know

Tuesday Tip How To Calculate Your Debt To Income Ratio

Indiana Paycheck Calculator Adp

Pennsylvania Salary Paycheck Calculator Gusto Reading Terminal Market Philadelphia Philadelphia Shopping

Indiana Paycheck Calculator Smartasset